Loading... Please wait...

Loading... Please wait...- Digital Playground

- Buy

- Subscribe to DLSUB

-

Info

- DLSUB Match or Beat Any Verified Price

- DLSUB Deliver Here is the Proof

- DLSUB Members Download Every Course in the DLSUB VAULT for Free

- Why DLSUB GOLD ELITE Annual Membership is a No Brainer

- Unlock DLSUB 365K Worth of Learning For Just a Dollar a Day

- DLSUB Members Only Pay $1.49 Per Course

- DLSUB Lifetime Subscription

- Not a DLSUB Member No Problem

- DLSUB Members Get 30 Premium Trading Courses for Just $245

- How DLSUB works

- What Does DLSUB Stand For

- DLSUB Rewards

- DLSUB Dropping Soon

- DLSUB LIFETIME

- DLSUB Refund Policy

- Contact DLSUB

- Sitemap

📩 For Download Links → Email: admin@dlsub.net

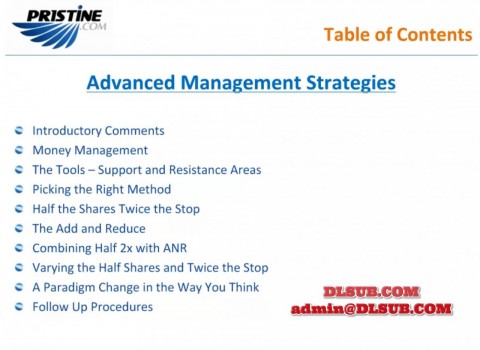

Pristine - Paul Lange - Advanced Management Strategies

Format: Online Course + Interactive Learning + Exclusive Resources

Level: Advanced

Duration: Self-paced (Lifetime Access)

Price: $1995

Course Overview:

Pristine - Paul Lange - Advanced Management Strategies is a comprehensive course designed for experienced traders and professionals who want to refine their management skills in trading and investment strategies. Taught by Paul Lange, a seasoned market strategist and risk management expert, this course provides advanced insights into optimizing trading performance, managing portfolios, and maximizing profitability while minimizing risk.

Paul Lange’s Advanced Management Strategies focuses on the core principles of capital management, trade management, and portfolio optimization, aimed at giving you the tools to handle complex market conditions with confidence and precision. Whether you are trading equities, forex, commodities, or futures, this course is structured to help you master the art of managing risk, controlling emotions, and adapting to market dynamics to ensure consistent success.

The course covers advanced concepts such as position sizing, portfolio diversification, trade execution, and capital preservation strategies, allowing you to grow your account steadily while minimizing the impact of market volatility. With practical techniques and a focus on real-world application, Paul Lange will guide you through advanced strategies to manage trades in a variety of market environments effectively.

What You’ll Learn:

1. Advanced Trade and Portfolio Management

- Position Sizing: Learn how to calculate the optimal position size based on your account balance, risk tolerance, and volatility levels, helping you avoid overexposure while maximizing your profit potential

- Risk-to-Reward Ratios: Develop the skill to assess potential trades using precise risk-to-reward calculations, ensuring each trade has a higher likelihood of generating profits with acceptable risk

- Trade Management: Master techniques for managing trades once they are opened, including trailing stops, adjusting targets, and exiting strategies to lock in profits and protect against reversals

- Portfolio Diversification: Learn how to construct a diversified portfolio that balances risk across multiple assets, sectors, or timeframes, helping you reduce volatility and increase returns

- Capital Allocation: Understand how to allocate capital between different types of assets, balancing your overall portfolio to optimize growth while mitigating risk exposure

2. Advanced Risk Management

- Comprehensive Risk Assessment: Learn to conduct a thorough risk analysis for each trade and investment, evaluating factors such as market conditions, trade setups, and event-driven risk

- Loss Mitigation Techniques: Understand the various stop-loss strategies and how to adjust them based on changing market conditions to minimize losses while giving your trades room to breathe

- Portfolio Risk vs. Individual Trade Risk: Discover how to weigh and manage the risk of individual trades within the context of your overall portfolio, ensuring that no single loss can significantly impact your financial position

- Managing Volatility: Gain insights into how to adjust your strategies to account for periods of market volatility, adapting to changes in market sentiment and price movements

- Hedging Strategies: Learn advanced hedging techniques to protect your portfolio against unexpected market movements, including the use of options, futures, and other instruments

3. Emotional and Psychological Control in Trading

- The Psychology of Risk: Dive deep into the psychological aspects of trading, learning how to control emotions like fear and greed to prevent them from negatively affecting your trading decisions

- Mental Resilience: Build the mental fortitude needed to stay disciplined and stick to your trading plan even during periods of high market uncertainty or after a string of losses

- Psychological Traps: Recognize common psychological traps that traders fall into, such as revenge trading, overtrading, and confirmation bias, and learn how to avoid them

- The Role of Patience in Trading: Understand the importance of patience in trading, learning to wait for high-quality setups instead of acting impulsively

- Building a Trading Routine: Develop a structured trading routine that helps you maintain focus, discipline, and consistency in the face of market fluctuations

4. Advanced Execution Techniques

- Order Types and Timing: Master the use of different order types (market orders, limit orders, stop orders) and how to effectively time them to capture optimal entry and exit points

- Slippage and Execution Risk: Learn how to manage execution risks such as slippage and spread widening, ensuring your trades are executed at favorable prices

- Real-Time Trade Adjustments: Learn how to adjust your trade as market conditions evolve, including how to scale in and out of positions effectively

- Timing the Market: Discover how to use technical analysis and market internals to anticipate turning points in the market and adjust your strategy accordingly for optimal execution

- Leveraging Trading Tools: Learn how to integrate advanced tools such as algorithmic trading, trade automation, and risk management software into your daily trading practice

5. Creating a Sustainable Trading Plan

- Trade Strategy Formulation: Learn how to develop and refine your own trading strategies based on proven principles, ensuring they align with your financial goals, risk tolerance, and trading style

- Setting Realistic Goals: Set achievable and measurable trading goals, both in terms of financial targets and skill development, and develop a roadmap to reach them

- Adapting to Market Conditions: Understand how to modify your strategy based on changing market conditions, such as periods of high volatility, bullish or bearish trends, and unexpected events

- Consistency and Performance Tracking: Learn how to track your trading performance using trade journals, performance metrics, and other tools to measure success and identify areas for improvement

- Long-Term Sustainability: Develop a mindset focused on consistent profitability and capital preservation, learning how to grow your trading account in the long term while managing risk effectively

6. Practical Application and Live Case Studies

- Real-Time Case Studies: Gain practical insights into advanced trade and portfolio management strategies by analyzing live trade examples and case studies from Paul Lange’s trading experience

- Trade Simulation: Engage in simulated trading exercises to practice implementing advanced management strategies and refining your decision-making process

- Group Coaching and Feedback: Participate in group coaching sessions, where Paul Lange offers feedback on real trades, providing advice on improving strategies and outcomes

- Weekly Market Reviews: Get access to in-depth weekly market analysis and reviews, where Paul Lange breaks down current market conditions, potential setups, and advanced strategies for navigating them

- Exclusive Resources: Receive additional resources, such as advanced trade management worksheets, checklists, and templates, to apply the strategies learned in the course

Bonus Content:

- Access to a Private Community: Join an exclusive community of experienced traders to share insights, strategies, and experiences

- Ongoing Mentorship: Access continuous support from Paul Lange through follow-up mentorship sessions, ensuring that you remain on track with your trading goals

- Lifetime Access to course updates, new strategies, and additional material on risk management and trade execution

- Special Trading Tools: Receive access to a suite of advanced trading tools, including risk management calculators and portfolio optimization software

Who This Course Is For:

- Experienced traders who have a solid understanding of technical analysis and are looking to develop advanced strategies to manage their trades, portfolio, and risk more effectively

- Investors who want to learn how to optimize their capital allocation and develop a sustainable, long-term trading plan

- Professionals who seek to improve their risk management skills, adapt to changing market conditions, and gain a competitive edge in trading

- Individuals aiming to build a consistent, disciplined approach to trading and reduce emotional decision-making that impacts profitability

Course Outcomes:

By the end of Pristine - Paul Lange - Advanced Management Strategies, you will:

- Be proficient in advanced risk management and trade execution, with a focus on protecting your capital while maximizing returns

- Have a deep understanding of capital allocation, position sizing, and portfolio diversification for building long-term wealth

- Be equipped with a personalized trading plan and the mindset needed to maintain consistency and resilience in the face of market challenges

- Be able to apply advanced techniques for trade management and risk mitigation across multiple asset classes and market conditions

- Have the tools, strategies, and psychological discipline to sustain profitability over time and adapt to evolving markets